You’ve got a steady paycheck from your 9-to-5 job, and that’s cool. But deep down, you know you’ve always wanted more. More money. More freedom. More flexibility. And so you decide it’s finally time to increase your current income.

One of the best ways to earn more with little effort is to build a passive income stream. This article breaks down 23 ideas for how to generate passive income while keeping your full-time gig. So you can finally make more than you’ve ever dreamed of.

What is passive income?

Passive income is money you earn that doesn’t require you to do a lot of “active” work to continue making it. In essence, you can do most of the work upfront and put in some additional effort along the way to earn an income.

For example, if you create an online course, you just need to update its content to keep the money flowing.

→ Click Here to Launch Your Online Business with Shopify

You’ve probably heard the expression “make money while you sleep.” That’s the biggest draw that entices people to earn passive income.

You can create something (a blog, course, ebook, videos, or an online store) that generates money even when you’re not working. Or you can make passive income investments (property or stocks) that allow you to earn passively. (We’ll tell you more ways to earn like this shortly.)

Active income vs. passive Income: Which is best for me?

In theory, all of your income sources carry similar weight. But when it comes to achieving financial freedom, passive income leaves active income in the dust.

You see, active income is the money generated from all those efforts you’re currently making. And you need to keep working if you want to continue making a living. If you quit, you don’t get paid. Your time literally equals money.

And then you have passive income. An income that doesn’t require you to work actively. And the money continues to flow in for years and years. If you’re looking to design a dream life where you are financially free, it might be better for you to focus on passive income.

Just remember, while you might be able to build a passive income stream with a small investment, you’re not making any less of a commitment than someone investing their time. Making passive income comparable to income earned from active efforts requires a good amount of work upfront.

23 passive income ideas to help you make money in 2024

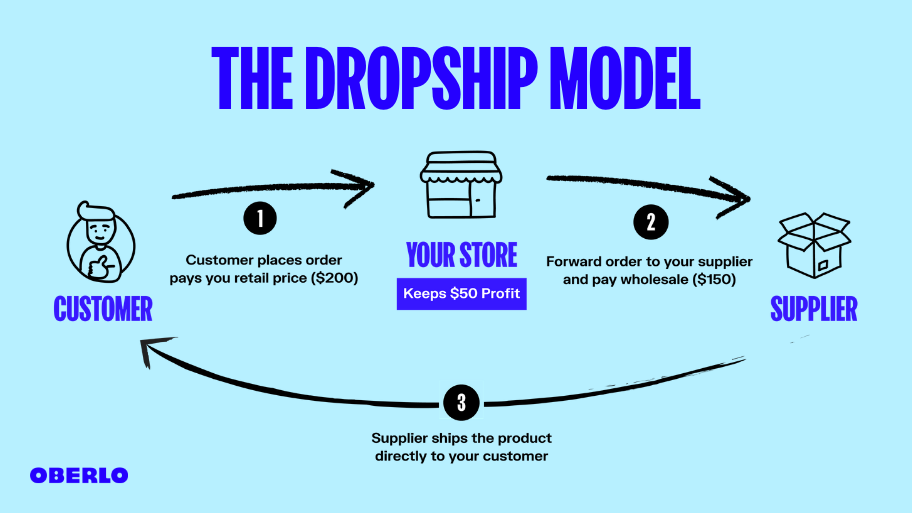

1. Start a dropshipping store

Dropshipping is one of the most profitable passive income sources. With dropshipping, you can find trending products on marketplaces like AliExpress to sell to customers around the globe. You can fill your online store with items from various dropshipping niches, such as fashion, home décor, or beauty.

The magic of dropshipping is that you build your own business and decide how much you charge for the products. In fact, from all the passive income ideas on this list, dropshipping is the one where you have the most control over your margins.

You can sign up for Shopify to start dropshipping today. Once you create an online store, install one of these dropshipping apps to find high-quality products to sell.

Note: A close alternative to a dropshipping store—but with a lot more input into product selection and quality control—is buying wholesale products to sell on your store. Using a wholesale marketplace, you can connect with local US-based suppliers, purchase products at wholesale prices, and sell them on to your audience. You can even combine this option with dropshipping by finding wholesalers who are willing to send products directly to your customers.

2. Build and monetize a blog

Another popular passive income stream originates from blogging. Blogging has helped countless entrepreneurs earn passively through affiliate links, courses, sponsored posts, products, book deals, etc.

It can indeed take quite a bit of upfront work to build a successful blog. However, it’s one of the most sustainable ways to generate an audience through organic and social traffic or building an email list. The biggest perk of having a blog is that you can turn that one asset into several different streams of income.

So, if you’re looking for an easy passive income idea, blogging might be the perfect option for you.

Desirae Odjick, founder of Half Banked, explains, “I started my blog to make talking about personal finance more approachable, and as part of that, I tend to share a lot of personal stories. They often included shout-outs to the tools I was using and found helpful, so it was a natural transition to add affiliate links as I joined those companies’ programs.

“Now that I’ve been covering personal finance for almost four years on my blog, those links reliably bring in four figures every month, as people discover my articles and start to get their finances in order—and I feel fantastic recommending them, because I do personally use all of my affiliate products. It’s a great way to add passive income to your business, especially if you don’t have passive products of your own to sell … yet!”

3. Create and sell online courses

If you’re an expert in some subject or field, selling online courses may be a great passive income idea for you. Whether you sell them through your own website or online learning platforms like Udemy, you’ll find plenty of individuals who are willing to pay to access your content.

Of course, things are easier if you sell on platforms like Udemy, but your course may be heavily discounted during certain periods. This will affect how much passive income you earn. In contrast, selling through your own website gives you control over pricing, meaning you don’t have to sacrifice your margins just because others are selling at a discounted price.

Sumit Bansal, founder of TrumpExcel says, “I started a blog about Excel spreadsheets in 2013. I did it as I was learning a lot about spreadsheets and thought it would be a good way to share my knowledge with others. It slowly started getting traction in two years; it was getting 100,000+ page views a month. I decided to create an online course and see if it would fly, and it did. I made a good side income for a few months and then decided to do this full time and launch more courses. Since then, the blog has grown a lot, and I have been featured on many prominent sites and publications such as Problogger, YourStory, GlassDoor, CEO Magazine, etc.”

4. Publish Instagram sponsored posts

If you have followers on Instagram, you might want to try your hand at creating sponsored content. Instagram sponsored posts are content pieces that endorse a specific product or service (usually owned by the sponsoring party). Sponsors compensate publishers for creating and distributing content that promotes their business.

The secret to getting sponsored is to get more Instagram followers. You’ll also want to be super consistent with the type of content you post so sponsors know what to expect. And be sure to focus on just one niche—brands prefer creators who can publish quality content around a specific topic.

When it comes to your Instagram bio, be sure to add your email address. As your account grows, you can hire virtual assistants to create sponsored posts on your behalf. The more sponsored post requests you get, the more passive income you will be able to generate.

5. Create a print-on-demand store

With ecommerce being one of the most popular ways to make passive income online, it only makes sense to give a shout-out to print on demand.

Print on demand allows you to sell your custom graphics on products like t-shirts, clothing, mugs, canvases, phone cases, bags, and more. The best thing about this is that you can build your own branded products.

The only downside is that you need to be savvy at graphic design, because the margins are often too thin to outsource the designs affordably. However, if you create that unique winning design, your sales will take off. Plus, it’s not a super competitive business, since other brands are unlikely to sell the same designs. Don’t hesitate to start right away with Shopify!

How profitable is print on demand? Find the answer in our collaboration with Wholesale Ted, where we compare dropshipping with print on demand.

Veronica Wong, the founder of Boba Love, shares how her love of bubble tea helped her earn passive income: “I’ve been drinking bubble tea for as long as I can remember, so combining my love for boba with my love for design seemed like a perfect fit. I started designing and selling bubble tea apparel and accessories last year and the journey has been incredible. With Printful handling the production, fulfillment and shipping, I can focus on marketing and building my brand. I’ve connected with boba lovers all over the world and recently reached 10,000 followers on Instagram. I’m just starting my journey to earning more passive income, but Shopify and Printful make it very easy, and I am very optimistic!”

6. Create an app

By now, you’ve probably noticed a trend: creating stuff tends to lead to passive income. This is even more true in the world of mobile software. If you’re a developer or programmer, you might want to try creating apps as a passive income stream.

You can go about it in two ways. First, you can charge a fee for people who want to buy your app. Second, you can make your app free and monetize with ads. My fiance did this a few years ago and still makes a side income from his app to this day.

He bought code from CodeCanyon. Then, he used a tool called Eclipse and installed the Android development SDK to make modifications to the code to create his own unique app. You can monetize an app in a number of ways, including running in-app advertising, offering paywalled content, and charging for premium features.

7. Invest in stocks

When analyzing the income sources of the world’s richest people, it’s pretty safe to say that stocks have played a big role in their deep, endless bank accounts.

While the act of investing in stocks is pretty passive, the research that goes into it is active. Warren Buffett reads 500 pages a day, but he’s not reading your average mystery book. Nope. He reads business’s annual reports. By doing this he better understands whether or not a business is performing well, which helps him improve his ability to invest in stocks.

Stock investments can help you earn passive income that stretches far beyond what your value at your 9-to-5 job is worth. So, consider this passive income idea if you’re up-to-date on various markets and industry movements.

8. Buy and sell properties

Depending on where and when you buy, real estate can be a good way to make passive income. In popular cities like Dubai, housing prices have been projected to rise by an impressive 12% to 20% compared to the average prices from the previous year.

By purchasing pre-constructed condos, you may land some lower-cost properties that’ll increase in value by the time it’s finally built, allowing you to sell the property for a profit once it’s complete.

As with all investments, it can be risky, so it’s best to speak with a real estate agent if you’re new to the game to help you buy the right investment property.

Shawn Breyer, owner of Breyer Home Buyers, shares: “My girlfriend, now wife, graduated law school with $173,000 of school debt, and we set the duration of the loan to be paid over 15 years, which made our monthly payments come out to be $1,459 per month. We wanted to use rental property cash flow to cover our monthly law school debt. Our first decision was to buy a duplex and live on one side while we rented out the other side. This alone saved us the $1,350 in housing expenses that we had prior to buying the duplex.

“Instead of allocating that money towards extra principal payments on the school debt, we saved that money and bought another duplex two years later. This acquisition added $650 in monthly cash flow, which we snowballed into a third property. The three properties provided us with an extra $2,500 per month in savings and income that we were able to then put toward extra principal payments. The beauty of this approach is that our tenants are paying down our law school debt and if we were to lose our jobs or have a medical emergency, then we can rely solely on the rental income to pay for the school debt for us.”

9. Rent out your spare room

If you have an extra room in your apartment, you can rent it to someone for a specific duration. Platforms like Airbnb will connect you with people who are looking for their next gateway. Airbnbs are preferred because they’re usually cheaper than hotels, meaning you can make a higher passive income by listing your free space on Airbnb.

It’s worth noting that becoming an Airbnb host requires work upfront. You might have to renovate or furnish your room before listing it on the marketplace. To make it truly passive, you can hire a part-time property manager to create listings and look after your properties. Keep in mind, though, that they’ll charge a monthly fee between 8% and 10% of the monthly rent collected.

Martin Dasko, founder of Studenomics, makes passive income renting his condo on Airbnb. He explains, “I decided to give Airbnb a shot when I stayed in one on a visit to NYC. I loved the concept and wanted to get in on it. I put my condo up for rent and was surprised by the demand. I was able to charge $169/night in downtown Toronto. My biggest win came when a company contacted me because they were sending a few employees to Toronto.

“They booked the unit for the entire month. I didn’t have to worry about finding new guests. The beauty of Airbnb is that you can turn it on and off as you please. When you’re looking to make some extra cash, you can put your place up for rent. You can also rent out that spare bedroom.”

10. Become an affiliate marketer

Affiliate marketing is one of the best passive income opportunities available today. The upside to it is that almost every big brand has an affiliate program, so you can sell some pretty popular products and rake in the dough.

The downside is that you only make a commission on the sale. Shopify’s affiliate program, for example, allows you to earn up to $58 per referral, which is a decent income. Other online companies only give a measly $5 to $10 in referral bonus.

So you’ll want to make sure you do some research into the best affiliate marketing programs before you get started. Blogging tends to be the most cost-effective way to make recurring affiliate commissions without having to spend money on ads.

Sireesha Narumanchi, founder of Crowd Work News, shares, “I started my side hustle as a blogger a little over two years ago, and this has been the most incredible journey so far. As a content creator, most of my income is from affiliates, and it’s totally passive. It wasn’t easy to juggle my job and business, but it was totally worth it. I do put in a lot of hours researching, crafting, and working on business strategies, but once my content is done, it generates income passively again and again. The immense pleasure of helping people and showing them that there is a choice of working from home and earning a decent income is my trophy at the end of the day.”

11. Sell your videos

If you always find yourself in the midst of drama and excitement, you might want to pull out your phone and hit Record. Doing that can help you make some passive income. The latest video marketing stats indicate that people are obsessed with video content, so you should be able to find an audience for your films.

Why? Because you can sell that video to a news site. And if the video takes off, you can make some recurring money for weeks, months, and sometimes even years. Of course, the easiest way to get in on the action is to be at public events such as protests, demonstrations, and festivals.

Wherever there’s controversy, you’ll find opportunities for your content to be sold. And if you’re good at producing entertaining content, companies will pay you to create viral videos along with offering a share of overall earnings.

Peter Kock, owner of Seller at Heart, shares how he made passive income uploading videos to popular websites: “I uploaded a few videos to Newsflare and Rumble. When my content gets bought, 50% of all revenue generated gets wired to my personal account. My videos were featured on MSN, AOL, Yahoo, Daily Mail, The Guardian, etc. With Newsflare, I made over $4,000 so far and still I’m getting royalties for videos uploaded a few years ago.”

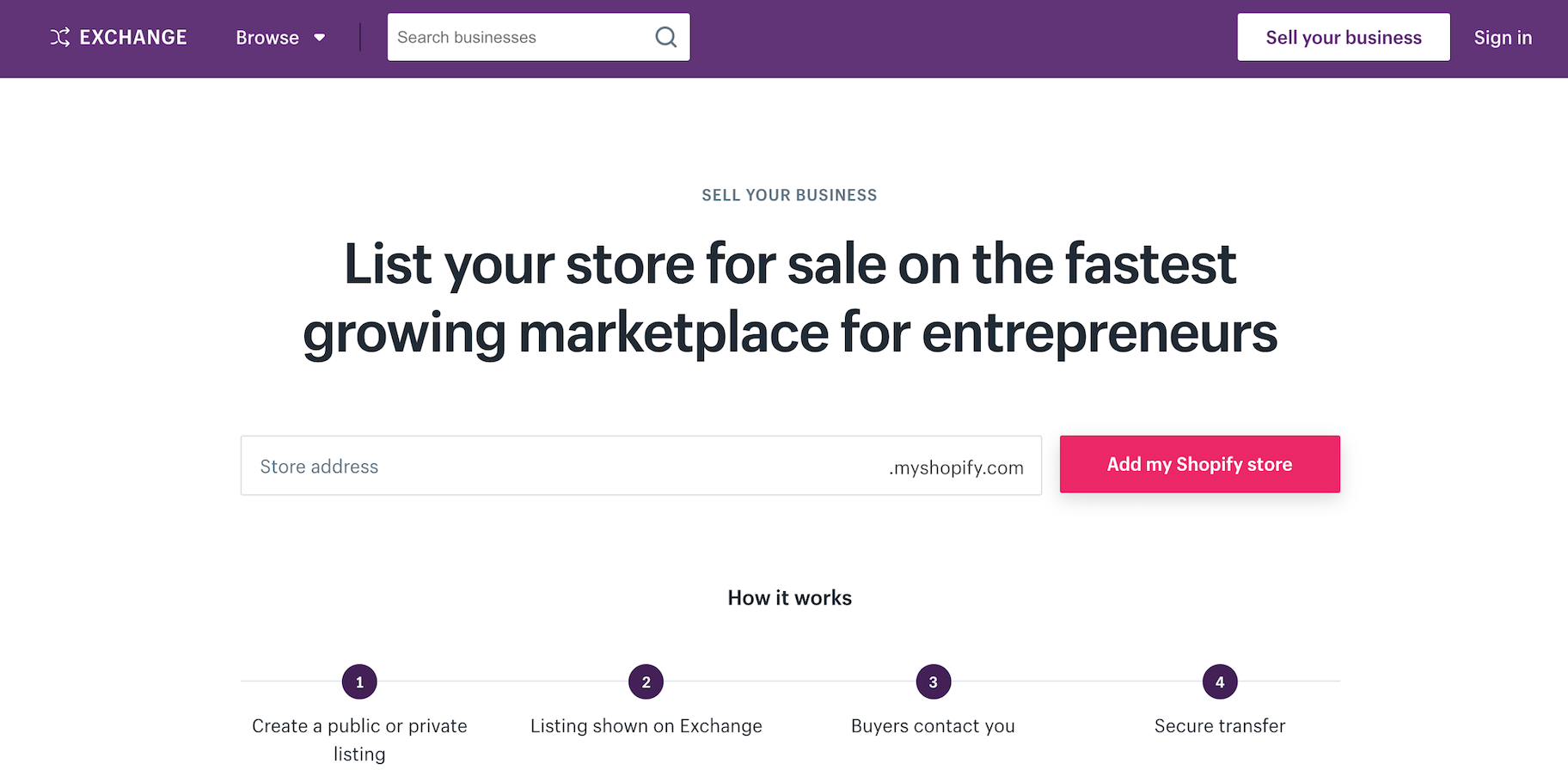

12. Buy and flip websites

Do you have experience of creating ecommerce websites? If so, you could make passive income building and selling them.

You’ll likely need to generate some revenue (to prove that your store has potential). But if you’ve got great design skills and can put up some content on your website, you could sell it to someone looking to purchase a pre-built ecommerce store.

If you’re looking for a place to sell your website, you could try out Shopify’s Exchange marketplace. On the platform, you can sell your newly built online store or your advanced six- or seven-figure store. It’s the perfect platform for website flipping.

13. Ask for company stocks

Yup, your 9-to-5 job can also become a passive income stream. No, it’s not the hours you work. However, your company shares or any company-matching retirement plans can help you score some pretty decent passive income.

I actually used this passive income method to pay for the downpayment on my condo. And it only took two years. Of course, you’ll likely need to invest some of your own money, but the extra bit that the company adds is a nice perk, if you’re willing to try it. (And trust me, few people ever do.)

If you’re starting a new 9-to-5 job, be sure to ask for company stocks as part of your hiring package. You’ll thank me later.

14. Start a YouTube channel

YouTube is the passive income stream that just keeps on giving. From sponsored videos to ad revenue, you’ll find that you can make recurring income from your YouTube channel.

The secret to creating a successful YouTube channel is creating content on a consistent schedule for a long time. Make sure every video you upload is well made and something people want. If you stick with it for the long haul, you’ll eventually start reaping the passive income rewards.

Already have a YouTube channel? Check out our article How to Make Money on YouTube for ideas on how to monetize your video content.

Matthew Ross, co-owner and COO Slumber Yard, started his passive income journey on YouTube: “Back in 2013, my business partner and I were extremely interested in wearable technology—Garmin watches, Fitbit activity trackers, etc.—and decided to start a YouTube channel that would review these types of products. We really just enjoyed testing out the watches and thought we could earn a little advertising money on the side.

“In total, we invested about $5,000 creating the channel and purchasing the products to review. However, around that time, the wearable technology category exploded and we started making more money than we ever imagined. Needless to say, I managed to turn my hobby into a business. We’ve been able to grow top-line revenue to over $2.5 million, we’ve hired 10 full-time employees, and we recently moved the company’s headquarters to a new state-of-the-art 7,000-square-foot office in Reno, Nevada. Today, our websites and YouTube channels attract over four million visitors per month, combined.”

15. Sell your photography

While being a photographer may seem like an active income business, it’s actually not. Photographers don’t only make money from taking photographs. They sell them too. Stock image sites, magazines, and canvas printing for your clients are some of the ways you can make big bucks in the photography space.

All you need to get started is a great camera. But these days, you can even use your smartphone to capture amazing images. Consider taking high-quality photos and listing them on stock photography sites to earn income in the form of royalties.

Jacob Hakobyan makes passive income with his photography business, Shotlife Studio. He shares, “Having profound business education and what some may consider as very stable office jobs, we felt that we had the potential to do more. Not financially, but spiritually. As a brother-sister-husband trio, we started Shotlife Studio simply because we all had a common love for photography, and there was an added thrill of leading a business of our own. With our CPA knowledge coming to aid, we prepared a clear strategy on the growth of the business and managed to double our profits from year to year, reaching a five-figure side income.“

16. Help businesses bring in clients

Are you a savvy marketer or salesperson? If so, there are tons of businesses that will pay you referral fees for bringing more clients to them.

For example, DJs, photographers, and other solopreneurs are always looking to grow their customer base. If you manage to find clients that sign a long-term contract, they’ll happily pay you a referral bonus.

So if you are good at networking, you can start building a passive income through your connections. All it takes to get this business started is a couple of emails or messages.

17. Write an ebook

Ebooks exploded onto the scene around 2010 and are still a hugely popular content medium. Anyone with expert knowledge in a particular subject can write an ebook to share their thoughts with the world. You don’t have to go at it alone. Platforms like Upwork make it easy to find book writers and editors who can help with the process.

You’ll need to publish your manuscript through Amazon Kindle to make it available for your audience. Some marketing is also required to get the word out to as many people as possible. Once you break into the ebook space, it’s possible to create passive income through page reads and Kindle sales, which is how most ebook writers make money.

Allie McCormick makes passive income by creating ebooks. She explains, “In 2016, when I was pregnant with my son, I started an Amazon Kindle publishing side hustle to hopefully earn just $500 per month by the time he was born so I could avoid going back to the office. While I didn’t quit working immediately, 18 months later, I had a six-figure passive income business that enabled me to do so. Biggest win? This business still runs mostly on autopilot to this day. I work on it one to two hours weekly and take three to four weeks off at a time while still raking in the dough!”

18. Sell your unwanted stuff

Looking to follow Marie Kondo’s advice and start decluttering your home? Well, you might want to turn that clutter into cold, hard cash.

We all have those piles of boxes filled with stuff we haven’t thought about in years. You can either hold onto it for a chance to end up on an episode of Hoarders or you can sell it online to help you make passive income. You might have to dig deep, but you may find you have some items that are worth some serious cash.

So if you don’t know where to start when it comes to passive income, your closet might be your best bet.

19. Create and sell digital products

Digital products are media assets people can’t touch physically. They typically include downloadable files such as audiobooks, PDFs, templates, or plug-ins.

Digital products have high profit margins because no inventory or storage costs are incurred. You only have to make the asset once and you can sell it repeatedly. There’s no limit on the number of copies you can sell.

You can create a Shopify store to sell your digital products online. Selling these products is the epitome of passive income, as the entire process can be automated on Shopify with instant downloads.

Kelan and Brittany Kline, the duo behind The Savvy Couple, tell us, “Last month, we launched a Shopify store with a few digital products to sell to our readers. Specifically, we made the Budgeting Binder to help people learn how to organize their finances and start to budget. Since the launch, our shop has made us over $1,500 in sales and continues to grow each week. Since all of our products are digital, this income is completely passive. As long as we continue to funnel readers to our shop, we continue to get sales.”

20. Use passive income apps

Passive income apps work exactly as they sound—you install them on your smartphone and perform a few actions to earn money. The actions can range from doing everyday activities, such as watching videos to turning a small financial investment into a passive income stream. There are plenty of apps to start putting your mobile device and time to better use. Here are a few good ones:

- Fundrise. Fundrise lets you invest in real estate projects with an initial minimum investment of $1,000. It comes with the option to take quarterly dividends, which serve as your passive income.

- InboxDollars. InboxDollars offers cashback for doing activities that you’re likely to do anyway, such as shopping, watching TV, and searching the web. The cashback and the $5 bonus for signing up are your passive income.

- Dosh. Dosh gives you the option to link your debit and credit cards to its system. When you pay for something using these cards, you earn passive income in the form of cashback.

21. Create and license audio tracks

If you have some audio skills, why not put them to work? Making audio tracks for other people’s use is a great way to earn extra cash, as people are constantly looking to brand themselves with the right sound.

You can license your tracks out on platforms like SoundCloud and Audiosocket if you want to create full songs and earn some passive income via royalties. All you need to do is research your audience and find out what kind of content is trending. From there, you can quickly start building your portfolio of tunes. You never know—it might transform into something bigger.

If you find a passion for creating audio, you can experiment with a wide range of different products, from intros and outros to full albums and mixing samples. Alternatively, your audio track can be as simple as a jingle or a podcast intro.

22. Make income from your unused space

Space is a valuable commodity that most of us don’t have enough of. Whether you’re currently only using your storage room part-time or having extra space in your home, there are tons of ways to create some extra income with that unused space. For instance, you can rent out storage spaces on sites like Neighbor.com, so people have an extra place to keep their belongings.

If you have room in your garage or even an extra parking space, you can rent these out simultaneously. If you’re booking a space for an event and you don’t need it all the time, you can look into sites like Share My Space, where you can advertise your available square footage to anyone who needs it.

Alternatively, you can offer employees and professionals without an office a great place to work comfortably. This way, you’ll earn passive income while the renters get a comfortable work environment. It’s win-win!

23. Create a job board

A job board is a website used by employers to promote job vacancies to people. People can apply for vacant roles remotely with a few clicks. You can charge companies to post on your board, and upsell features like unlimited access to your talent pool to increase your earnings.

You can either design a job board from scratch or buy a premade theme and start there. The bulk of your effort should be devoted to creating awareness for your job board. You can write a press release, post on social media, and run paid ads to get traction early.

Once you build a solid clientele of regular, trustworthy customers, you can expect a large part of your income to be passive. Check out sites like Dribbble or Problogger for inspiration.

Strengthen your financial future with these passive income ideas

Passive income can really help elevate your earnings and fill in the gaps that your 9-to-5 job can’t fill on its own. If you’re looking to create an additional income stream so you can strengthen your financial future, the ideas on this list can help you do that.

And it’s OK if you like your full-time gig too. The work that goes into earning passive income tends to be manageable when paired with a 9-to-5. So, yup, you can do both.

→ Click Here to Launch Your Online Business with Shopify

Whether you’re looking to start a dropshipping store, start your own agency, or create profitable content, you’ll find that there’s money to be made in all these areas. All you need to do is get started.

Passive income FAQ

How can I generate passive income?

You can generate passive income ideas in myriad ways. For instance, you could write down all the things that interest you and research how other people build businesses around them. Another idea is to brainstorm how to solve a common problem you have and build it into a passive income idea.

What passive income ideas can I start with little money?

There are many passive income ideas you can start with little money. These include dropshipping, affiliate marketing, print on demand, and selling your unused things.

How much passive income can I earn?

You can make as much or as little passive income you want. However, it’s not a get-rich-quick scheme. You’ll need to put in some hours, effort, and capital initially to create a passive income source. The good news is that nailing these things early allows you to sit back and enjoy the financial rewards for years to come.

You may invest as little as $100 in the beginning, then reinvest your profits until your passive income grows to a sustainable figure. With a high-recurring income, you can make enough money to live a happy, healthy life.

What are the best passive income ideas for 2024?

- Start a dropshipping store

- Sell courses online

- Monetize a blog

- Create a job board

- Invest in the stock market

- Create a print-on-demand store

- Sell stock photos online

- Become an affiliate marketer

- Flip websites for a profit

- Own a rental property

Want to Learn More?